take home pay calculator madison wi

P the principal amount. Calculates Federal FICA Medicare and.

Wisconsin Income Tax Calculator Smartasset

This 7500000 Salary Example for Wisconsin is based on a single filer with an annual salary of 7500000 filing their 2022 tax return in Wisconsin in 2022.

. Well do the math for youall you need to do is enter. Cigarettes are taxed at 252 per pack in Wisconsin. Living Wage Calculation for Wisconsin.

The tax rates which range from 354 to 765 are dependent on income level and filing status. Switch to Wisconsin hourly calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

After you request a waiver begin. The assumption is the sole. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin.

The most typical earning is 52000 USDAll data are based on 292 salary surveys. Supports hourly salary income and multiple pay frequencies. Wisconsin Salary Paycheck Calculator Change state Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator.

This free easy to use payroll calculator will calculate your take home pay. Sample Car Loan Amortization Schedule Template Car loan. If youre eligible for a 10000 bonus you might only come away with just over 6000 of.

This is the 19th-highest cigarette tax in the country. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after.

For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. To use our Wisconsin Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. State Date State Wisconsin.

If youre eligible for a 10000 bonus you. Living Wage Calculation for Madison WI. Transportation expenses like bus fares and gas prices are 7.

Wisconsin Cigarette Tax. More information about the calculations performed is available on the about page. Demands for a living wage that is fair to.

Average salary in Wisconsin is 70058 USD per year. Wisconsin Mobile Home Tax. We issue a wage attachment for 25 of gross earnings per pay period.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin. The calculators we provide here can help you decide what type of mortgage is best for you whether you are considering purchasing a new home or deciding if it is the right time to. Enter your salary or wages then choose the frequency at which you are paid.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the. The 2022 wage base is 147000.

The Savannah Ios 14 App Covers Ios 14 Icon Covers Etsy App Covers Iphone Minimal Iphone Design Include the employees full name and the payment key Read More Take Home Pay. Salaries are different between men and. This Wisconsin hourly paycheck.

Overview of Wisconsin Taxes. The tax rates which range from 354 to 765 are dependent on income level and filing status. Madisons housing expenses are 9 higher than the national average and the utility prices are 5 higher than the national average.

After a few seconds you will be provided with a full breakdown. Wisconsin workers are subject to a progressive state income tax system with four tax brackets. Process and Data Services.

Wisconsin Department of Revenue. Calculate your take home pay from hourly wage or salary. The federal minimum wage is 725 per hour while Wisconsins state law sets the minimum wage rate at 725 per hour in 2022.

I your monthly interest rate. Bonuses are considered supplemental wages and as such are subject to a different method of taxation. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Simply enter their federal and state W-4 information as. You can alter the salary example. So if your.

Most employers tax bonuses via the flat tax method where an automatic 25 tax is. Free Online Paycheck Calculator for Calculating Net Take Home Pay.

Pin Van Michael Francis Op Diet Ideas Ketosis Diet Keto Diet Recipes Keto Supplements

Pin On Real Estate Infographics

The Best Cities For Renters In America Smartasset City Housing Market Best Cities

Wisconsin Paycheck Calculator Adp

Wisconsin Paycheck Calculator Adp

Outdoor Decor Somatic Cell Outdoor

Mt Olympus Wisconsin Dells Yahoo Image Search Results Wisconsin Vacation Wisconsin Dells Vacation Wisconsin Dells

Wisconsin Paycheck Calculator Smartasset

Wisconsin Retirement Tax Friendliness Smartasset

Pin By Amy Sausen On Uw Madison Type One Diabetes Diabetes Type 1 Diabetes

Pin By Jill On Flooring Flooring Hardwood Floors Home

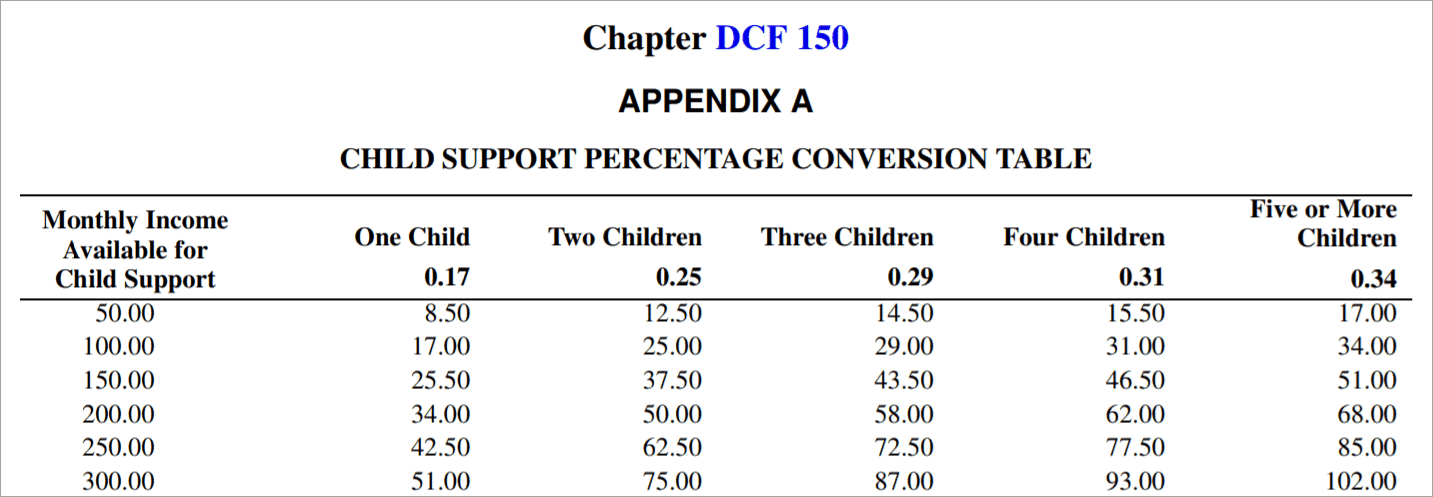

The Easiest Wisconsin Child Support Calculator Instant Live

Ergonomic Office Desk Chair And Keyboard Height Calculator Human Solution Interior Design Kitchen Contemporary Ergonomic Furniture Design Cool Office Desk

How To Calculate Adjusted Basis On Sale Of Rental Property Sapling Com Sapling Com Rental Property Daycare Buying Foreclosed Homes